Cash Flow Management Tips Every Small Business Should Know

Cash flow is the lifeblood of any business — especially startups. Even if you’re making sales, poor cash flow can cripple operations. Here’s how to keep your business solvent and your stress levels low.

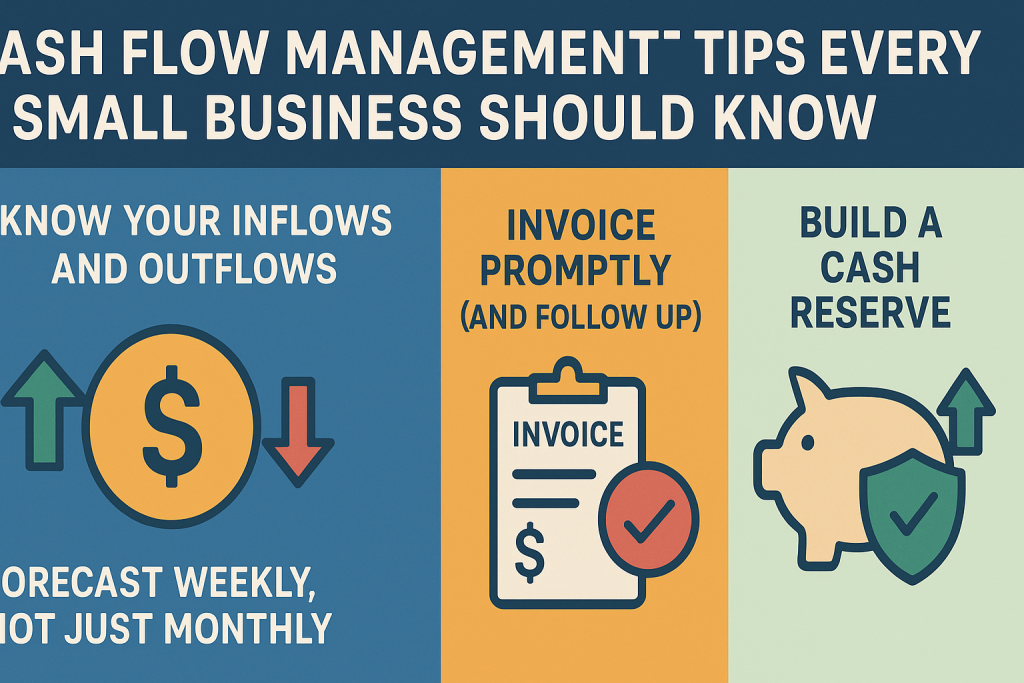

1. Know Your Inflows and Outflows

Track every dollar coming in and going out. Use simple tools like a spreadsheet or cloud software (e.g., QuickBooks, Wave) to monitor:

- Sales and revenue

- Rent, payroll, software, subscriptions

- Taxes and loan payments

2. Invoice Promptly (and Follow Up)

Delayed payments can sink you.

- Set payment terms (e.g., Net 15 or 30)

- Send automated reminders

- Offer small discounts for early payment

3. Build a Cash Reserve

Aim for 2–3 months’ worth of expenses in reserve.

Even a modest buffer can protect you from slow months or unexpected bills.

4. Forecast Weekly, Not Just Monthly

A monthly view might miss short-term gaps. A rolling 13-week cash forecast can give early warnings and prevent surprises.

Conclusion

Strong cash flow = strong business health. Start tracking, planning, and protecting your working capital today.

👉 Download our 13-Week Cash Flow Forecast Template to plan your liquidity with confidence.

Internal Link Suggestions:

- Financial Forecasting Methods

- Understanding Profit Margins