Disclaimer: This is an overview for non-mandated SMEs and not a formal legal/accounting advice

Sustainability Reporting: A Key to Success for Startups

Sustainability reporting is no longer a ‘nice-to-have’ for start-ups; it’s a financial necessity for securing capital, Acquiring & Retaining customers and attracting top talents.

Having advised startups through Series A funding, I’ve seen firsthand the growing importance of sustainability reports.

Like Price Differentiation or Cost Leadership strategies; Sustainability has evolved into a Distinctive Strategic Advantage that small businesses MUST optimize in order for them to Grow and remain Relevant.

A 2025 Executive Survey by Esg Post found that 97% of Global Executives believe Sustainability Reporting Will give their SMEs a competitive advantage and 96% of Investors Link it to Improved Financial Performance.

Another Research by DHL and Irish Government Showed that 75% of small susinesses said sustainability was extremely important to their operations as 42% saw improved customer Relations, 38% Saw Cost Savings, 30% experienced improved brand reputation; all of which contributed to competitive differentiation in the Market.

Beyond Green: Defining Sustainability through the Triple Bottom Line.

In Simple terms, Sustainability is the Ability of a Business to Meet its Current Needs without Harming the Future Generations Ability to Meet Theirs.

For a fintech Start up to be termed sustainable; its strategies must be a Triple Bottom Line; meaning it Optimises Profit (Economic), Planet and People (Staffs, Community, Pressure Groups).

One common misconception is clarified from that definition; which is that Sustainability ≠ “being green only”. It’s more than that. A sustainable business is one that combines and upholds both Environmental (Being Green), Social and Governance (ESG) principles into its strategy.

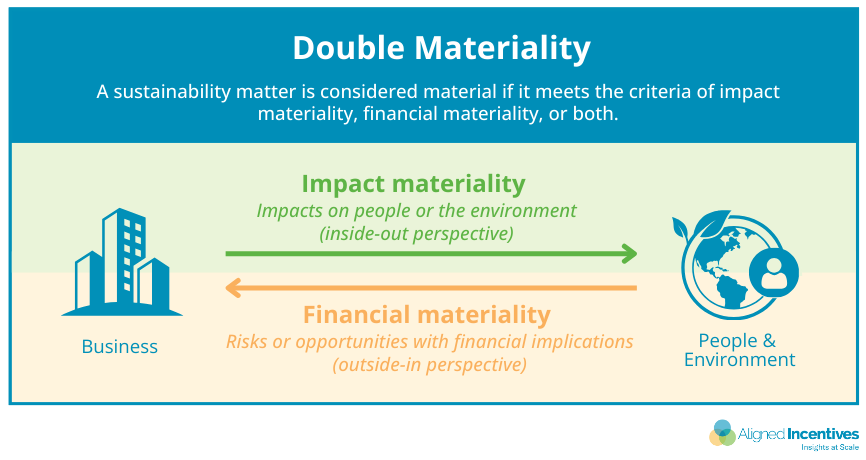

Defining the Sustainability Report: Why Accounting for Impact Matters (Double Materiality)

There are various guidance and standards available for Sustainability Reports (SR): Like the International Sustainability Standard Board (ISSB), the Global Reporting Initiative (GRI) and the Task Force on Climate Related Financial Disclosures (TCFD). These frameworks are developed for Large Corporations and It would be a big and Costly Mistake for SMEs to adopt them.

Globally, SMEs that are not listed are not mandated to create SR. however there are many Indirect benefits that SMEs can enjoy from having these reports published. Such as Access to Finance from banks and Investors and an improvement to the management of the sustainability Issues SME faces. Likewise these reports also help satisfy the data needs of Large corporations requesting SR from their suppliers (the SMEs).

The European Union is finalizing the VSME Standard, expected for voluntary use in 2025. This standard would aid comparability and uniformity amongst SMEs and it is based upon the Corporate Sustainability Reporting Directive (CSRD) of Double Materiality.

Unlike the IFRS S1 and S2 Single Financial Materiality framework, the EU’s ESRS requires that all sustainability matters be accessed using the double materiality principle (impact and financial Materiality). This means that all SR must provide relevant information on

- How the SME has had and is likely to have a positive or negative impact on people or on the environment in the short, medium or long term; and

- How the environment and social issues have affected or are likely to affect the SMEs’ financial position, performance and cash flows in the short,medium or long term.

Mastering the Basics: The 11 Core Disclosures from the European Sustainability Standards (VSME Focus)

To simplify the concept of this double materiality, the EU’s VSME standard created a basic and comprehensive module that guides SMEs in creating a globally recognised SR. The basic model is the minimum requirements for SMEs and the comprehensive module is what is likely to be requested by banks, investors or corporate clients (on top of the basic module).

The basic module would be focused on for the purpose of this article.

The basic module suggests that an SME provides two disclosures (B1 and B2) and also 9 basic Metrics (B3-B11). Each of these 11 Bs are summarised below.

- B1- Basis for Preparation (Disclosure)

Except the information is deemed sensitive or classified, the SME must disclose its legal form, its sector classification code, size of the balance sheet, revenue turnover, number of employees headcount, country of primary operations and geolocation of sites owned, leased or managed.

- B2– Practices, policies and future initiatives for transitioning towards a more sustainable economy (Disclosure).

B3-B7: Environmental Metrics

- B3– Energy and Greenhouse Gas Emissions (GHG)

In this section, the SME must disclose its total energy consumption in MWh; its Gross GHG emissions in tons of CO2 equivalent (scope 1-3) as well as its GHG Intensity.

Scope 3 reporting for SMEs is usually limited to upstream transport/purchased goods and is generally the hardest and often voluntary starting point. The scope 1 and 2 should be prioritized first.

- B4– Pollution of air, water and Soil.

The SME must disclose the pollutants it emits to air, water and soil in its own operations, with respective amounts for each pollutant.

- B5- Biodiversity.

The SME shall disclose the number and area (in hectares) of sites that it owns, has leased or manages in or near a biodiversity sensitive area.

- B6- Water.

The SME shall also disclose its total water withdrawals (amount of water drawn into the boundaries of the organisation); and the amount of water withdrawn at sites located in areas of high water-stress.

- B7– Resource Use, Circular Economy and waste management.

The SME shall disclose whether it applies circular economy principles as well as the total annual generation of waste and waste diverted to recycling or reuse.

From an economic point of view; optimizing B4-B7 would also lead to cost saving Initiatives for the SMEs as efficient waste management would lead to reduced disposal fee. Likewise, adequate water usage would lead to lower utility bills; re-enforcing the ability of the start up to be a cost leader in the market.

B8-B10 : Social Metrics

- B8- Workforce – General characteristics.

Here, the SME would typically disclose the number of employees in headcount for the following metrics: tyre of employment contract, gender and country of the employment contract.

- B9- Workforce- Health and safety.

The SME would disclose the number and rate of recordable work related accidents and the number of fatalities as a result of these injuries and work related ill health.

- B10- Workforce- Remuneration,collective bargaining and training.

The SME would disclose whether the employees receive pay that is equal to or above the minimum wage for the country it reports in;as well as the percentage gap in pay between its female and male employees.

Also the average number of annual training hours per employee, broken down by gender would be disclosed.

B8-B11 also helps the SMEs themselves in Monitoring and improving talent retention and legal/reputational risk management. For instance having a high pay gap is a talent risk that SMEs must be conscious about.

B11: Governance metrics

- B11- Convictions and fines for corruption and bribery.

If any, the SME shall disclose the number of convictions and total number of fines incurred for the violation of anti-corruption and anti- bribery Laws.

This metric is the foundation of investor trust. It proves that the company is well managed and ethical, which is a core component of Trustworthiness.

The Conclusion: Your Next Step to Financial Resilience

For startups and SMEs, adopting these basic disclosures is a proactive strategy for securing capital, reducing operational risk and optimizing costs.

By focusing on these practical, double materiality-based metrics, you are not simply writing a report; you are building a robust system that transforms environmental and social data into financially material information. This discipline ensures your business is resilient, competitive, and ready for the future demands of investors and regulators.

The complexity is manageable if you start small.